Lohnsteuer Kompakt: Overview- Lohnsteuer Kompakt Customer Service, Benefits, Features And Advantages Of Lohnsteuer Kompakt And Its Experts Of Lohnsteuer Kompakt.

Lohnsteuer Kompakt

Lohnsteuer Kompakt is an online tax service in Germany that helps individuals file their income tax returns easily and accurately. It provides a user-friendly platform where taxpayers can enter their personal and financial information, and the system automatically calculates their tax liability based on the given data.

What Is Lohnsteuer Kompakt?

Lohnsteuer Kompakt is an online tax filing platform in Germany that helps individuals prepare and submit their income tax returns. It simplifies the tax filing process by providing a user-friendly interface and automated calculations. Users can enter their personal and financial information, and the platform calculates their tax liability based on the data provided. The platform provides an intuitive and easy-to-use interface, making it accessible for individuals without extensive tax knowledge or experience. Lohnsteuer Kompakt automatically checks for errors, inconsistencies, or missing information in the tax return. This helps minimize mistakes and ensures the accuracy of the filing. Data security is a priority for Lohnsteuer Kompakt. The platform uses encryption and other security measures to protect users’ personal and financial information.

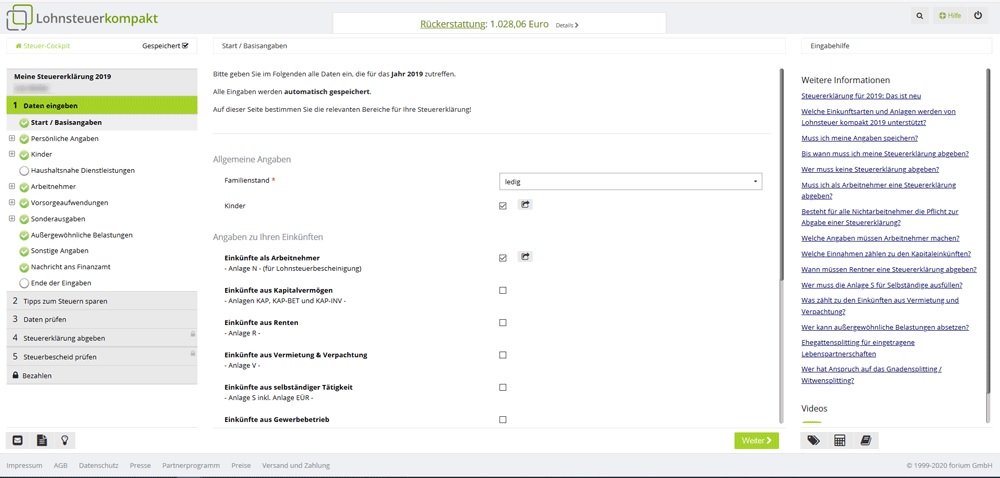

How To Use Lohnsteuer Kompakt

To use Lohnsteuer Kompakt, follow these general steps:

- Registration: Visit the Lohnsteuer Kompakt website and create an account. You may need to provide your email address and choose a password.

- Start a New Tax Return: Once you’re logged in, click on “Start new tax return” or a similar option to begin your tax filing process.

- Personal Information: Enter your personal details such as your name, address, date of birth, and tax identification number (Steueridentifikationsnummer). Follow the prompts and fill in the required information accurately.

- Income Details: Enter your income information from different sources such as employment, self-employment, pensions, rental income, etc. Provide the necessary details and amounts for each income source.

- Deductions and Expenses: Enter any deductions, expenses, and allowances that you are eligible for. These may include work-related expenses, education expenses, health insurance premiums, and other deductible items.

- Tax Optimization: Lohnsteuer Kompakt will search for potential tax optimizations and suggest ways to maximize your tax refund. Review the suggestions and apply the ones that are relevant to your situation.

- Finalize and Submit: Once you are satisfied with the accuracy of your tax return, you can proceed to the final step. Lohnsteuer Kompakt will calculate your tax liability or refund based on the entered information. Review the results and submit your tax return electronically.

- Payment and Filing Confirmation: If you owe taxes, Lohnsteuer Kompakt will provide information on how to make the payment. Once the tax return is successfully filed, you will receive a confirmation or acknowledgment.

Lohnsteuer Kompakt Customer Services

Lohnsteuer Kompakt offers various services to assist individuals with their tax filing needs. Here are some of the key services provided by Lohnsteuer Kompakt:

- Online Tax Return Preparation: Lohnsteuer Kompakt provides an online platform where individuals can prepare their income tax returns easily and conveniently. The platform guides users through a step-by-step process to enter their income, deductions, and other relevant information.

- Automated Calculations: The service uses advanced algorithms to automatically calculate the tax liability based on the information provided by the user. It takes into account various factors such as income, deductions, allowances, and tax credits to determine the final tax amount.

- Expert Support: Lohnsteuer Kompakt offers support from tax experts who can answer users’ questions and provide personalized assistance. Users can seek guidance on specific tax issues or clarification regarding the tax filing process.

- Secure Data Handling: The service prioritizes data security and uses encryption to protect users’ personal and financial information. Lohnsteuer Kompakt complies with data protection regulations to ensure the privacy and security of user data.

- Additional Services: Lohnsteuer Kompakt may offer additional services such as assistance with special tax situations, support for self-employed individuals, and guidance on specific tax-related topics.

Benefits, Features And Advantages Of Lohnsteuer Kompakt

Lohnsteuer Kompakt offers several benefits, features, and advantages that can make the tax filing process easier and more efficient for individuals. Here are some of the key benefits and advantages of using Lohnsteuer Kompakt:

- User-Friendly Interface: Lohnsteuer Kompakt provides a user-friendly and intuitive platform that simplifies the tax filing process. The step-by-step guidance and prompts make it easy for individuals, even those without extensive tax knowledge, to enter their information accurately.

- Expert Support: Lohnsteuer Kompakt offers support from tax experts who can provide personalized assistance and answer users’ tax-related questions. This expert support ensures that individuals receive accurate and reliable guidance throughout the tax filing process.

- Time and Cost Savings: By using Lohnsteuer Kompakt, individuals can save time and effort compared to traditional manual tax filing methods. The automated calculations, error checking, and optimization features streamline the process and reduce the likelihood of mistakes. This can also potentially save on professional tax preparation fees.

- Data Security: Lohnsteuer Kompakt prioritizes data security and implements measures to protect users’ personal and financial information. The platform uses encryption and complies with data protection regulations to ensure the privacy and security of user data.

- Convenience and Accessibility: With Lohnsteuer Kompakt individuals can file their tax returns online from the comfort of their own homes. The platform is accessible 24/7, allowing users to work on their tax returns at their own pace and convenience.

Experts Of Lohnsteuer Kompakt

- Convenient and accessible from anywhere with an internet connection.

- Easy to use interface that simplifies the tax filing process for individuals.

- Provides step-by-step guidance on tax deductions, credits, and allowances to maximize refunds.

Lohnsteuer Kompakt Conclusion

In conclusion, Lohnsteuer Kompakt is an online tax filing platform in Germany that aims to simplify the tax filing process for individuals. It offers a user-friendly interface, automated calculations, error checking, and tax optimization features to help users accurately prepare and submit their income tax returns. The platform also provides expert support from tax professionals, ensuring that users receive personalized guidance throughout the process. Lohnsteuer Kompakt prioritizes data security and complies with data protection regulations to safeguard users’ personal and financial information. Overall, Lohnsteuer Kompakt can save individuals time and effort, potentially increase their tax refunds, and provide a convenient and accessible way to file taxes online. However, it’s important to note that the platform may not be suitable for complex tax situations or individuals with unique circumstances, in which case seeking advice from a tax professional may be necessary. For the most accurate and up-to-date information about Lohnsteuer Kompakt and its services, it is recommended to visit their official website or contact their customer support.