Yes Bank Overview

Yes Bank is a prominent private sector bank in India. Established in 2004, it has since grown to become one of the leading financial institutions in the country. The bank offers a wide range of services including savings and current accounts, fixed deposits, loans, credit cards, and various investment products.

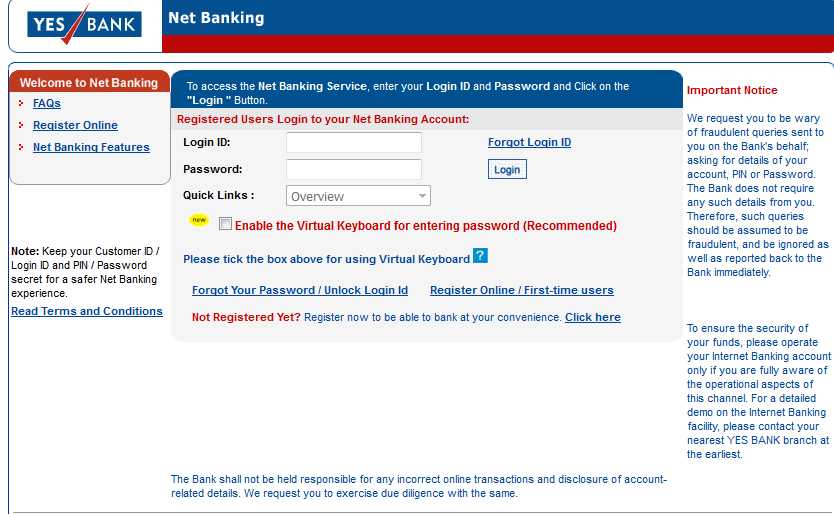

Yes Bank is known for its innovative approach to banking and has been at the forefront of adopting digital technologies to enhance customer experience. It provides online banking services and a user-friendly mobile app for convenient access to accounts and transactions.

The bank also has a strong presence in the corporate banking sector, offering services tailored to the needs of businesses, ranging from small enterprises to large corporations. It provides solutions for trade finance, working capital, and various treasury services.

Yes Bank Services

- Savings Accounts: Yes Bank provides various types of savings accounts tailored to different customer segments. These may include regular savings accounts, salary accounts, and specialized accounts with specific benefits.

- Current Accounts: Designed for businesses, current accounts offered by Yes Bank provide facilities for day-to-day business transactions.

- Fixed Deposits: Yes Bank offers fixed deposit accounts with varying tenures and interest rates. These provide a secure way to save and earn interest.

- Debit and Credit Cards: Yes Bank issues debit and credit cards with a range of features, benefits, and rewards tailored to different customer needs.

- Personal Loans: These are unsecured loans offered by the bank to individuals for various purposes, such as medical emergencies, travel, education, etc.

- Home Loans: Yes Bank provides loans for the purchase, construction, renovation, and extension of residential properties.

- Car Loans: This product allows individuals to finance the purchase of a new or used car.

- Business Loans: Yes Bank offers various types of business loans, including working capital loans, term loans, and trade finance, to support the financial needs of businesses.

- Investment Products: These may include mutual funds, insurance products, and other investment options offered in collaboration with reputed financial institutions.

- Online and Mobile Banking: Yes Bank provides digital banking services, including online banking and a mobile app, for convenient and secure access to accounts and transactions.

- NRI Services: Yes Bank provides a suite of services tailored to the needs of Non-Resident Indians, including NRI accounts, remittances, and investment options.

Yes Bank Customer services

- Customer Care Helpline: Yes Bank has a dedicated customer care helpline that customers can call to seek assistance with their banking-related queries, concerns, or requests.

- Online Customer Support: Customers can reach out to the bank’s customer support team through the official website or mobile app. This may include features like live chat or submitting support tickets.

- ATM Services: Yes Bank’s ATMs provide various services, including cash withdrawals, balance inquiries, and fund transfers.

- Internet Banking Support: The bank offers online banking services, and customers can contact the bank’s support team for assistance with internet banking-related issues.

Yes Bank Benefits, Features And Advantages

- Innovative Banking Solutions: Yes Bank is known for its innovative approach to banking, offering cutting-edge digital solutions for convenient and secure banking experiences.

- Personalized Services: The bank often offers personalized services tailored to individual customer needs, such as specialized account types, custom financial solutions, and dedicated relationship managers.

- Convenient Online and Mobile Banking: Yes Bank provides user-friendly online and mobile banking platforms, allowing customers to manage their accounts, make transactions, and access various services from the comfort of their homes or on-the-go.

- Easy Loan Approval and Processing: Yes Bank strives to streamline the loan application and approval process, providing timely access to funds for various purposes like home purchases, vehicle loans, personal loans, and more.

Features:

- Digital Banking: Yes Bank provides a robust digital platform for online banking, allowing customers to perform various transactions, access account information, and manage finances conveniently from their computers or mobile devices.

- Mobile App: The Yes Bank mobile app offers a user-friendly interface for seamless access to banking services on the go, including fund transfers, bill payments, account statements, and more.

- ATM Services: Yes Bank has a wide network of ATMs across India, enabling customers to withdraw cash, check balances, and perform other ATM-related transactions.

- Corporate Banking Solutions: Yes Bank offers a suite of services for businesses, including working capital finance, trade finance, cash management, and other treasury services.

Advantages:

- Innovative Banking Solutions: Yes Bank is known for its innovative approach to banking, leveraging technology to provide cutting-edge solutions for a seamless and convenient banking experience.

- Digital Convenience: The bank offers robust online and mobile banking platforms, allowing customers to access their accounts, make transactions, and avail various services from the comfort of their homes or on the go.

- Competitive Interest Rates: Yes Bank provides competitive interest rates on savings accounts, fixed deposits, and other financial products, helping customers grow their savings.

- Efficient Loan Approval Process: Yes Bank strives to streamline the loan application and approval process, providing timely access to funds for various purposes like home purchases, vehicle loans, personal loans, and more.

Experts of Yes Bank

- Convenient and easy access to online banking services.

- Secure and encrypted connection ensures the safety of personal information.

- Provides a variety of banking features, such as fund transfers, bill payments, and account management.

- User-friendly interface with intuitive navigation for enhanced user experience.

- Availability of customer support for resolving queries or issues.

Yes Bank Conclusion

In conclusion, Yes Bank stands as a prominent player in the Indian banking sector, known for its innovative approach and customer-centric services. Offering a diverse range of financial products and solutions, the bank caters to the varied needs of individuals, businesses, and Non-Resident Indians (NRIs).

With its cutting-edge digital banking platforms, customers enjoy the convenience of managing their finances from the comfort of their homes or while on the move. Yes Bank’s commitment to security ensures a safe banking environment for its clientele.

Competitive interest rates, tailored financial solutions, and a comprehensive suite of business-focused services contribute to the bank’s appeal. Additionally, Yes Bank’s credit cards come with attractive offers and benefits, enhancing the overall banking experience.