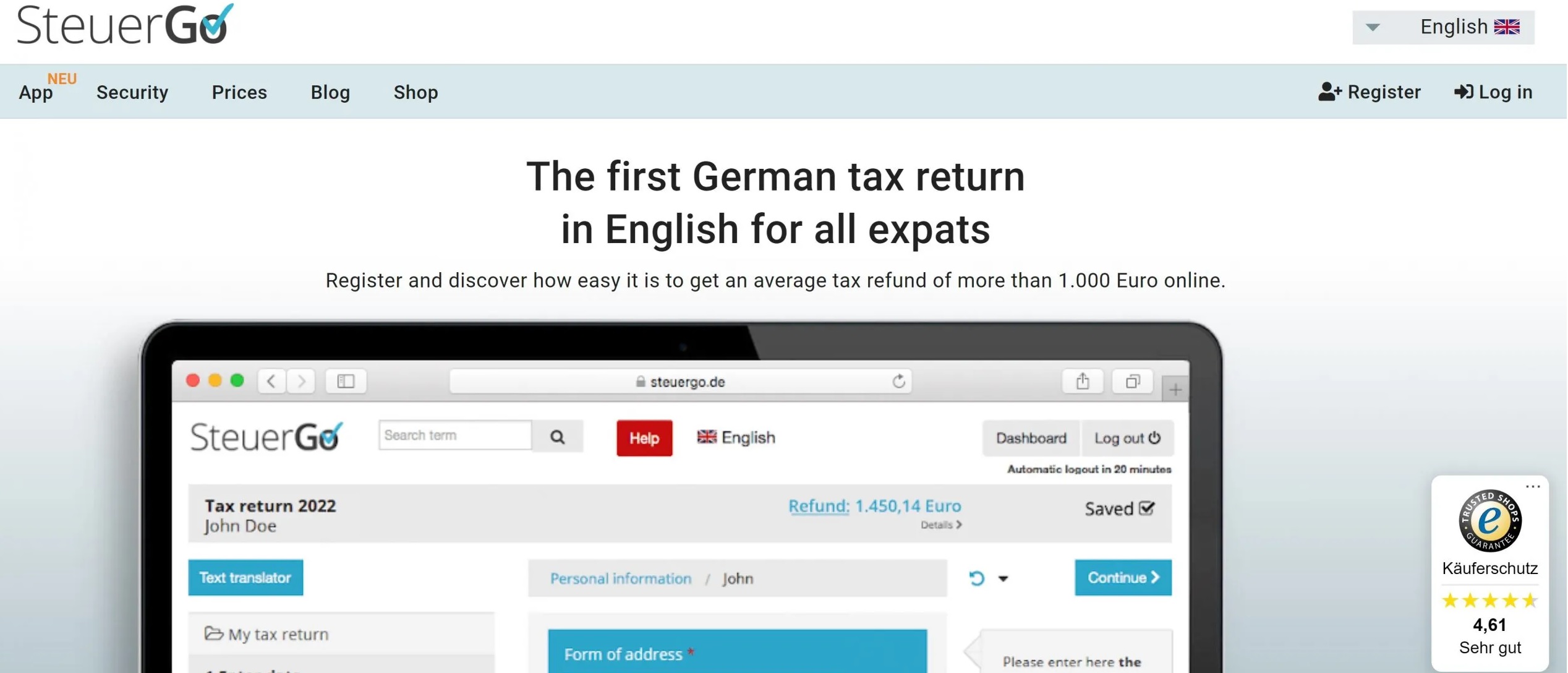

SteuerGo

SteuerGo is an online platform that helps individuals file their annual tax returns easily and conveniently. It offers support for various types of tax returns, including income tax, capital gains, and childcare costs. By using SteuerGo, individuals can streamline the tax filing process and potentially save time and effort compared to traditional paper-based methods. It aims to provide a user-friendly experience and guide users through the necessary steps to complete their tax returns accurately.

What Is SteuerGo?

SteuerGo is an online tax filing platform that provides individuals with a simplified and user-friendly way to file their annual tax returns. It aims to make the tax filing process easier and more accessible, particularly for individuals who may not have extensive knowledge or experience in tax matters. SteuerGo offers support for various types of tax returns, including income tax, capital gains, and childcare costs.

The platform guides users through the necessary steps to complete their tax returns accurately. It provides a streamlined interface where users can enter their personal and financial information, and the platform calculates the tax liability based on the provided data. SteuerGo also offers features such as automatic plausibility checks to help users identify potential errors or missing information. One of the advantages of SteuerGo is its convenience. Users can access and use the platform anytime and anywhere with an internet connection, eliminating the need for physical paperwork and in-person visits to tax offices. Additionally, SteuerGo aims to keep users updated with the latest tax regulations and changes, ensuring that the tax returns are filed in compliance with the current laws.

How To Use SteuerGo

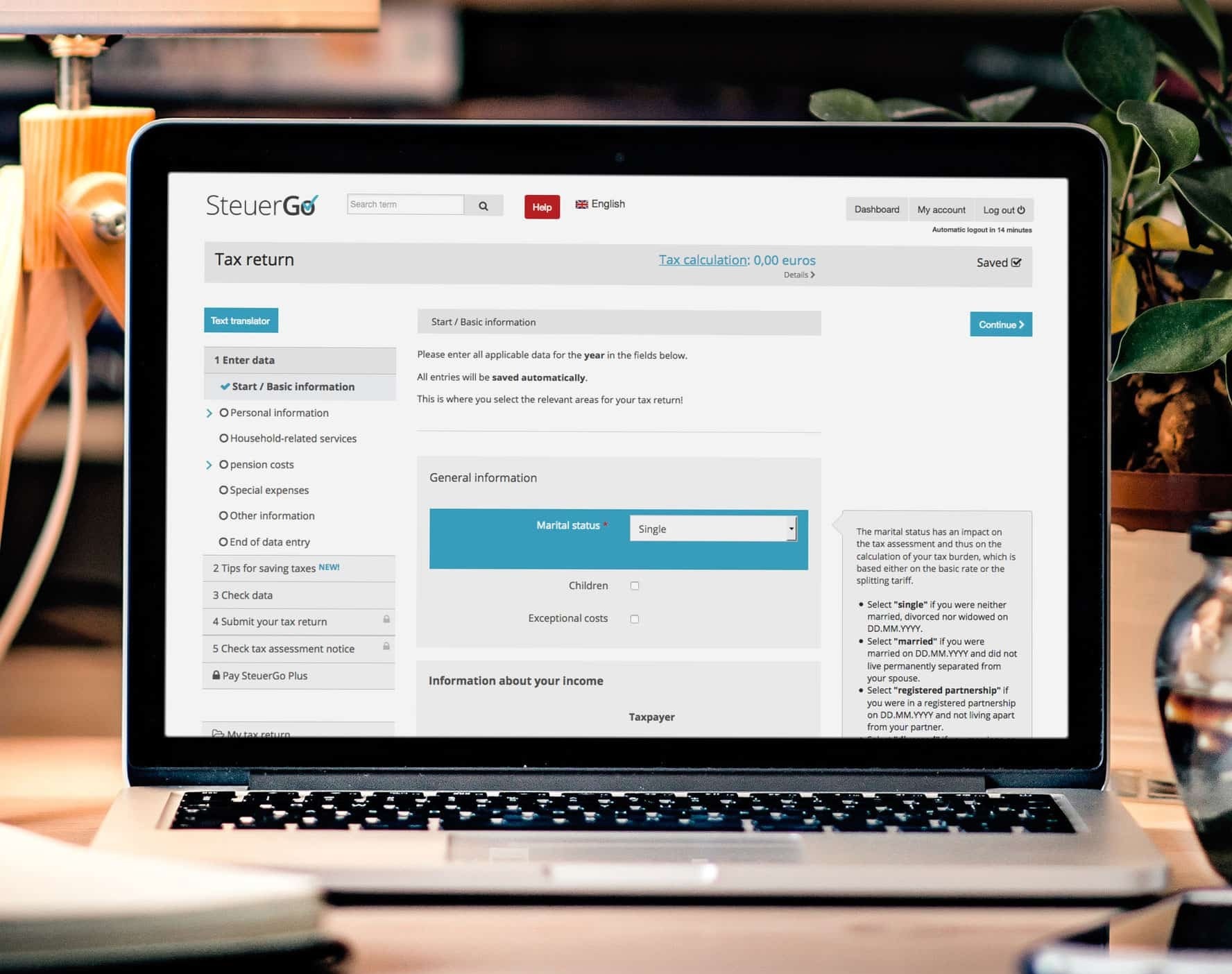

To use SteuerGo, follow these general steps:

- Visit the SteuerGo

- Create an account: Click on the “Registrieren” (Register) button and provide the necessary information to create a new account. This typically includes your email address and a secure password.

- Choose the tax year: Select the tax year for which you want to file your tax return.

- Enter your personal information: Fill in your personal details, such as your name, address, date of birth, and marital status.

- Provide your income information: Enter details about your income sources, including employment income, self-employment income, capital gains, and any other relevant income sources.

- Deductions and expenses: If applicable, provide information about deductions, expenses, and credits you may be eligible for, such as childcare costs, medical expenses, or donations.

- Submit your tax return: After verifying your data, submit your tax return electronically through the SteuerGo

- Payment and submission: If you owe taxes, SteuerGo will provide payment options and instructions on how to complete the payment. After payment, your tax return will be submitted to the relevant tax authority.

- Confirmation and assessment: You will receive a confirmation of the submission, and the tax authority will process your tax return. They may send you an assessment or request additional information if needed.

SteuerGo Customer Services

SteuerGo offers various services to individuals who want to file their tax returns online. Here are some of the services provided by SteuerGo:

- Online Tax Filing: SteuerGo provides a user-friendly platform where individuals can file their tax returns online. It supports different types of tax returns, including income tax, capital gains, and childcare costs.

- Step-by-Step Guidance: The platform guides users through the tax filing process, providing clear instructions and explanations for each step. It aims to simplify the process and make it easier for individuals who may not have extensive tax knowledge.

- Automatic Calculations: SteuerGo automatically calculates tax liabilities based on the information provided. It performs calculations for income tax, deductions, credits, and other tax-related calculations to ensure accurate results.

- Plausibility Checks: The platform performs automatic plausibility checks to help users identify potential errors or missing information in their tax returns. This helps ensure that the tax returns are accurate and complete.

- Data Import: SteuerGo allows users to import data from previous tax returns or other sources, such as tax documents received from employers or financial institutions. This can save time and reduce the need for manual data entry.

Benefits, Features And Advantages Of SteuerGo

SteuerGo offers several benefits, features, and advantages to individuals who choose to use their online tax filing platform. Here are some key benefits of using SteuerGo:

- User-Friendly Interface: SteuerGo provides a user-friendly interface that simplifies the tax filing process. It guides users step-by-step through the necessary sections and provides clear instructions, making it accessible for individuals who may not have extensive tax knowledge or experience.

- Time and Convenience: By using SteuerGo, individuals can save time and effort compared to traditional paper-based methods of tax filing. They can complete their tax returns at their own pace, from anywhere with an internet connection, without the need for physical paperwork or in-person visits to tax offices.

- Accuracy and Plausibility Checks: SteuerGo performs automatic plausibility checks on the entered data, helping users identify potential errors or missing information in their tax returns. This reduces the likelihood of mistakes and improves the accuracy of the filed returns.

- Automatic Calculations: SteuerGo’s platform automatically calculates tax liabilities based on the provided information. It performs calculations for income tax, deductions, credits, and other tax-related elements, ensuring accurate results without the need for manual calculations.

- Data Import and Reuse: SteuerGo allows users to import data from previous tax returns or other sources, simplifying the data entry process. This feature saves time and reduces the chances of errors when entering repetitive or extensive data.

Experts Of SteuerGo

- SteuerGo is a user-friendly platform, making it easy for users to file their taxes online.

- It offers a convenient and time-saving solution as users can complete their tax returns from the comfort of their own home.

- The platform is affordable, with transparent pricing and no hidden fees.

SteuerGo Conclusion

In conclusion, SteuerGo is an online tax filing platform that offers a user-friendly and convenient solution for individuals to file their tax returns. It simplifies the tax filing process, provides step-by-step guidance, and performs automatic calculations, reducing the chances of errors and saving time. The platform also offers features such as data import, plausibility checks, and up-to-date tax knowledge to ensure accurate and compliant tax returns.

Using SteuerGo can bring several benefits, including time and convenience, improved accuracy, secure data storage, and potential cost savings compared to traditional tax filing methods. It is designed to cater to individuals who may not have extensive tax knowledge or prefer a self-service approach to tax preparation. SteuerGo provides a reliable and accessible option for individuals seeking an easy and efficient way to file their tax returns online. It’s advisable to review the specific features, pricing, and terms of service on the SteuerGo website to determine if it aligns with your tax filing needs.