Introduction:

Managing personal finances can often feel overwhelming, with multiple accounts, bills, budgets, and investments to keep track of. Fortunately, Quicken, the ultimate financial management tool, is here to simplify your financial life. In this article, we will explore how Quicken can help you streamline your finances, track your expenses, create budgets, and plan for the future with ease and confidence.

Introducing Quicken

Quicken is a powerful personal finance software that has been trusted by millions of individuals for over three decades. Developed by Intuit, Quicken offers a comprehensive suite of tools and features designed to help users take control of their financial lives. Whether you’re an individual, a family, or a small business owner, Quicken provides the necessary tools to manage your finances efficiently.

Streamlining Financial Accounts

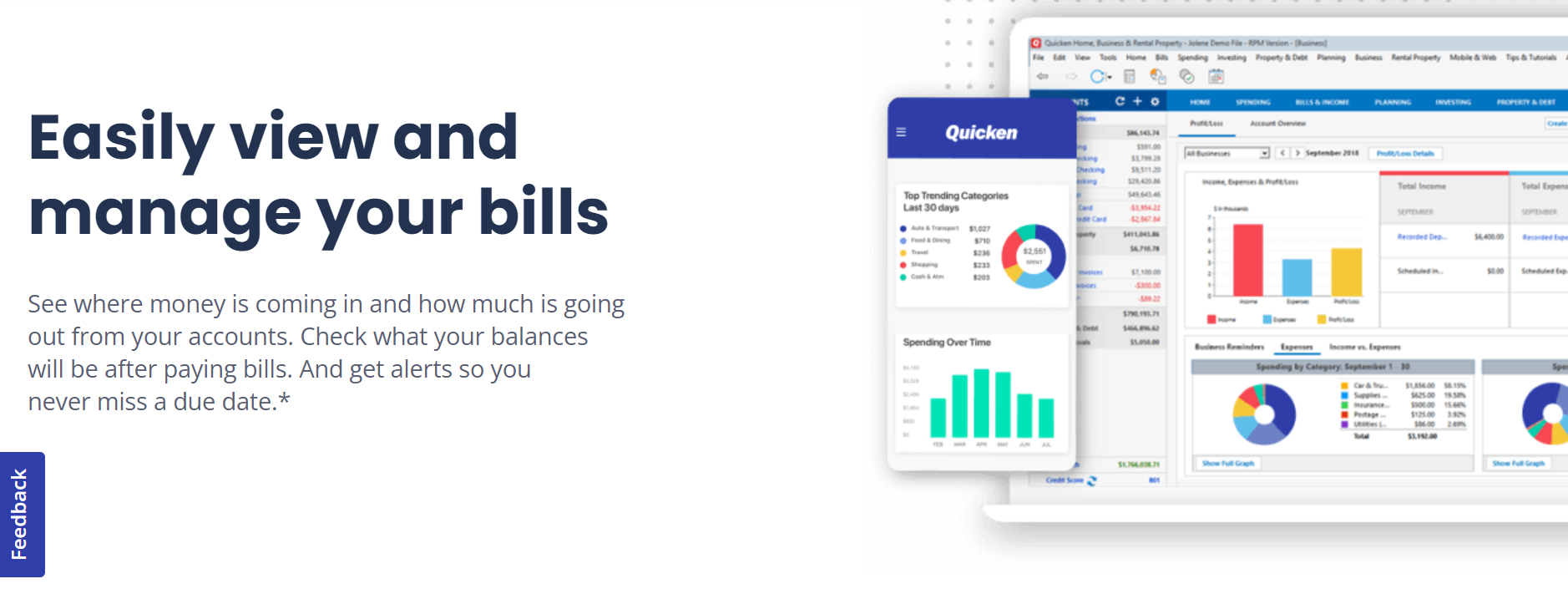

One of the key advantages of Quicken is its ability to consolidate all your financial accounts in one place. Whether you have checking accounts, savings accounts, credit cards, investments, or loans, Quicken allows you to link and synchronize them, giving you a comprehensive view of your financial picture. This simplifies the process of tracking transactions, monitoring balances, and reconciling accounts.

Tracking and Categorizing Expenses

Quicken makes it easy to track and categorize your expenses, helping you understand where your money is going. With features like automatic transaction downloads and categorization, you can quickly analyze your spending patterns, identify areas where you can save, and make informed financial decisions. Quicken’s robust reporting capabilities also enable you to generate detailed expense reports and visualize your financial data.

Creating and Managing Budgets

Budgeting is a crucial aspect of financial management, and Quicken offers powerful tools to create and manage budgets effectively. You can set up customized budgets based on your income, expenses, and financial goals. Quicken’s budgeting features provide real-time updates, allowing you to track your progress, monitor spending against your budgeted amounts, and make adjustments as needed. This helps you stay on track and achieve your financial objectives.

Planning for the Future

Quicken goes beyond day-to-day financial management by helping you plan for the future. The software provides tools for retirement planning, investment tracking, and goal setting. You can analyze your investment portfolio, evaluate performance, and make informed decisions to grow your wealth. Quicken’s retirement planning tools help you estimate your retirement savings needs and track your progress towards your retirement goals.

Reminders and Bill Management

Keeping track of bills and due dates can be a challenging task. Quicken simplifies bill management by sending you reminders for upcoming bills and allowing you to schedule automatic payments. You can view your bill history, track payment status, and maintain a clear overview of your financial obligations. This feature helps you avoid late fees, stay organized, and maintain a healthy financial routine.

Security and Data Privacy

Quicken understands the importance of security and data privacy when it comes to financial management. The software utilizes robust encryption technology to protect your sensitive information. Quicken also provides secure data storage options, backup capabilities, and password protection features, ensuring that your financial data remains safe and confidential.

Conclusion:

Quicken serves as the ultimate financial management tool, empowering individuals and businesses to simplify their finances and gain control over their financial lives. With its comprehensive suite of features, including account consolidation, expense tracking, budgeting, future planning, bill management, and robust security measures, Quicken provides a powerful and user-friendly platform to streamline your financial tasks. By using Quicken, you can take charge of your financial journey, make informed decisions, and achieve your long-term financial goals with ease and confidence.