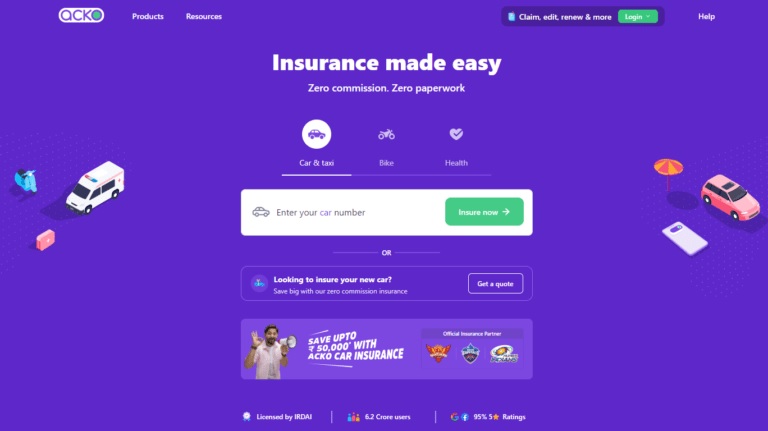

Acko offers a range of insurance products such as car insurance, bike insurance, health insurance, and travel insurance. The company operates entirely online, allowing customers to purchase and manage their insurance policies through their website or mobile app.

Acko is known for its innovative use of technology to make insurance more accessible and affordable for consumers. For example, the company uses AI and machine learning algorithms to streamline the claims process, allowing customers to file and track claims in real-time through their mobile app.

In addition, Acko offers customized insurance plans that are tailored to each customer’s individual needs and usage patterns. This helps customers save money on insurance premiums by only paying for coverage that they actually need.

Overall, Acko is a promising player in the insurance industry, and its focus on leveraging technology to provide better customer experiences sets it apart from traditional insurance companies.

What Is Acko?

Acko is an insurance technology company based in India that offers a range of insurance products such as car insurance, bike insurance, health insurance, and travel insurance. The company was founded in 2016 by Varun Dua, a former executive of insurance company Coverfox.

Acko operates entirely online, allowing customers to purchase and manage their insurance policies through their website or mobile app. The company is known for its innovative use of technology to make insurance more accessible and affordable for consumers.

For example, Acko uses AI and machine learning algorithms to streamline the claims process, allowing customers to file and track claims in real-time through their mobile app. In addition, Acko offers customized insurance plans that are tailored to each customer’s individual needs and usage patterns, helping them save money on insurance premiums by only paying for coverage that they actually need.

Acko has received funding from a number of investors, including Amazon, Accel, and SAIF Partners. The company has also won several awards for its innovative approach to insurance, including the “Insurtech Company of the Year” award at the 2020 Insurance Asia Awards.

Acko Customer service

Acko provides customer service through various channels, including phone, email, and chat support. Customers can also manage their policies and file claims through the Acko website or mobile app.

To reach Acko’s customer service team, customers can call the company’s toll-free number, which is available on their website. They can also send an email to the company’s customer support email address or use the chat feature on the Acko website or mobile app to connect with a customer service representative.

Acko’s customer service team is available 24/7 to assist customers with their insurance needs. They can provide information on insurance products, help customers purchase or renew policies, and assist with claims processing.

Overall, Acko is known for its responsive and helpful customer service, with many customers praising the company’s prompt and efficient handling of claims and other insurance-related issues.

Acko Quality

Acko is known for providing high-quality insurance products and services to its customers. The company uses innovative technology to offer affordable and customized insurance plans that are tailored to each customer’s specific needs and usage patterns.

One of Acko’s key strengths is its customer-centric approach to insurance, which puts the needs and preferences of customers at the forefront of its business. This is reflected in the company’s easy-to-use website and mobile app, as well as its responsive and helpful customer service team.

Acko also has a strong reputation for processing claims quickly and efficiently. The company’s use of AI and machine learning algorithms helps to streamline the claims process, allowing customers to file and track claims in real-time through the Acko mobile app.

Benefits, Features And Advantages Of Acko

There are several benefits, features, and advantages of using Acko for your insurance needs:

- Affordable and Customizable Insurance Plans: Acko offers a range of insurance products at competitive prices, allowing customers to choose the coverage they need at a price that fits their budget. The company also offers customizable insurance plans that can be tailored to each customer’s specific needs and usage patterns.

- Innovative Use of Technology: Acko uses advanced technology such as AI and machine learning algorithms to streamline the insurance process, making it faster and more efficient for customers. The company’s mobile app also allows customers to manage their policies, file claims, and track the status of their claims in real-time.

- 24/7 Customer Service: Acko’s customer service team is available 24/7 to assist customers with their insurance needs. The company’s responsive and helpful customer service has earned it a strong reputation for customer satisfaction.

- Quick and Efficient Claims Processing: Acko’s use of technology helps to speed up the claims process, allowing customers to file and track claims quickly and easily through the Acko mobile app. This helps to minimize the time and hassle associated with filing an insurance claim.

- Strong Financial Backing: Acko has received funding from a number of reputable investors, including Amazon, Accel, and SAIF Partners. This helps to ensure that the company has the financial resources to continue providing high-quality insurance products and services to its customers.

Experts Of Acko

- Acko offers customers a wide range of insurance products to choose from.

- Acko follows a simple and convenient paperless process for buying and claiming insurance policies.

- Acko has personalized plans that can be tailored according to the customer’s needs.

- Acko provides cashless hospitalization support for health insurance policyholders.

- Acko has competitive prices for its insurance products compared to other providers.

Acko Conclusion

In conclusion, Acko is an insurance technology company based in India that offers a range of affordable and customizable insurance plans for car insurance, bike insurance, health insurance, and travel insurance. The company’s innovative use of technology, including AI and machine learning algorithms, has helped to streamline the insurance process, making it faster and more efficient for customers. Acko’s 24/7 customer service and quick claims processing have also earned the company a strong reputation for customer satisfaction. Overall, Acko is a promising player in the insurance industry, with a customer-centric approach and a focus on leveraging technology to provide better customer experiences.